Days

:

Hours

:

Minutes

:

Seconds

You missed out!

A NO-COST, one-day sales intensive

For employee benefits agency owners and producers to sharpen their sales skills, expand their portfolio and grow their book with consultative selling and high-performance self-funded plans.

2025 is upon us and the

SALES YEAR STARTS IN JANUARY

Our mission at NextGen Benefits has remained steadfast for the past 10 years… continue to educate and train brokers to grow their business by empowering employers to move to self-funded plans and manage their healthcare supply chain.

Registration Fee

$199

WAIVED

NO COST TO ATTEND

thanks to the generous support of our dedicated and vetted sponsor partners.

Virtual Conference

NO NEED TO LEAVE YOUR OFFICE.

See why you should attend:

ARE WE A FIT FOR YOU?

This conference is NOT for you if…

…you’re satisfied with your hit (close) rate and the business you have.

If that’s you… you can move on!

…you’re an employee benefits broker satisfied with representing the interests of the Insurance carriers and not your clients.

If that’s you… you can move on!

However, you ARE in the right place if you are:

Do one or more of the above resonate?

If you can see the value and benefit of being a healthcare benefits adviser whose interests align with their prospect’s business objectives…

…if you recognize the opportunity to win new business by being differentiated…

…we have an incredible, potentially life-altering day in store for you!

Designed for producers & agency owners looking to sharpen their sales skillset and develop or strengthen their self-funding knowledge.

This one-day, NO COST virtual event doubles down on the NextGen Benefits ASCEND conference's 10 years of success in disrupting the health benefits industry.

Thousands of brokers have attended our events to discover how to win new business and grow your book by moving employers to self-funding and deploying healthcare cost-containment.

These strategies have not only changed the lives of their clients and employees, but imagine if YOU could :

- Develop immediate credibility with a company’s CEO or CFO

- Control your meetings from the driver’s seat instead of the back seat

- Close 25-50% more business next year

- Never again have to sweat your renewals

Hear what NextGen Benefits members and past conference attendees have to say about NextGen Benefits and Nelson Griswold:

WHAT DO YOU GET?

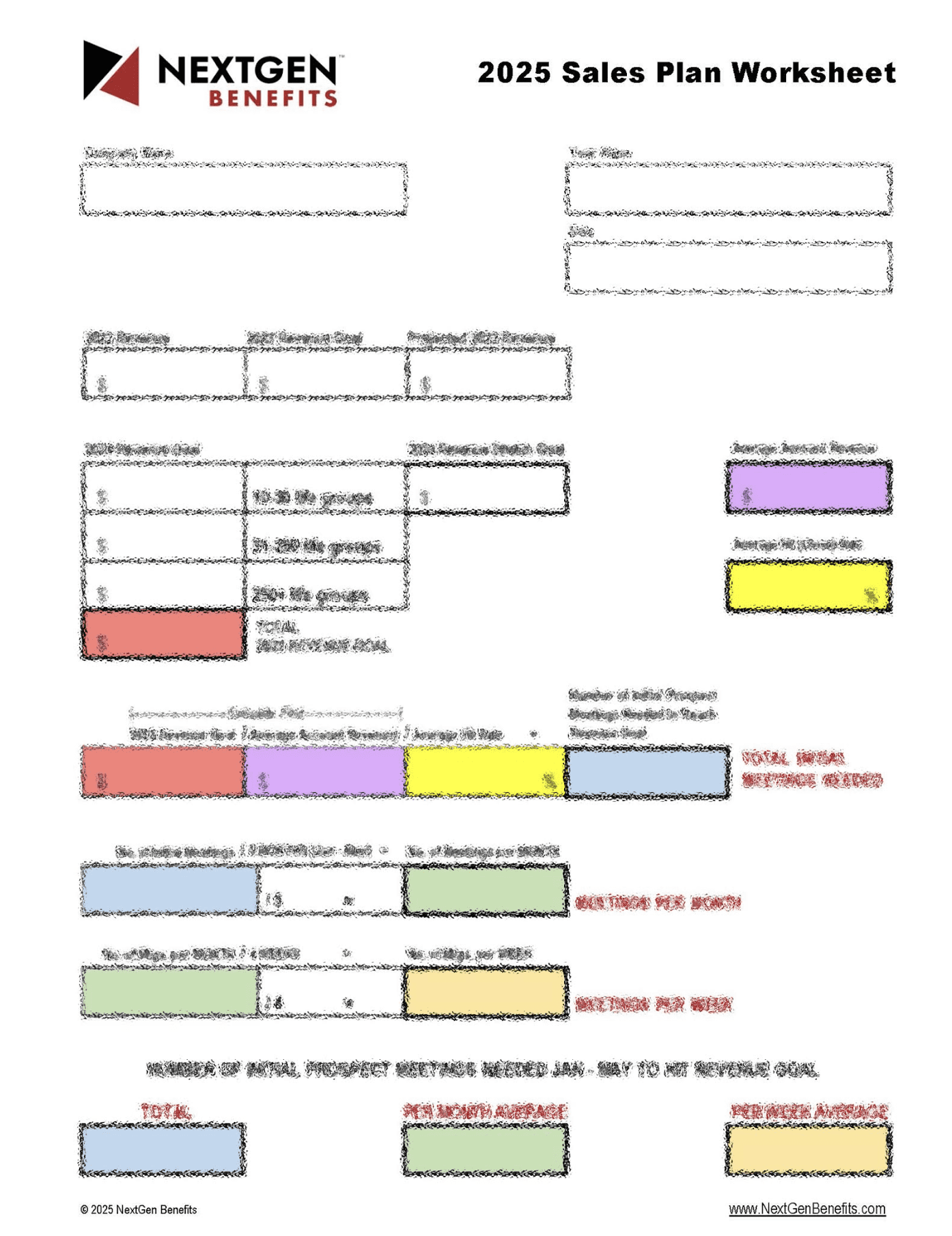

Your Personalized

2025 Sales Plan

In a Sales Success Workshop, you’ll be guided through creating your own 2025 Sales Plan.

With the correct inputs, if you follow your Sales Plan, you are GUARANTEED to hit your sales goal!

To further guarantee success in hitting your 2025 sales goal, you’ll also…

Gain a powerful competitive edge over brokers in your market

Learn the proven skillset that differentiates you from your competitors and drive prospect meetings to closure using: Consultative selling, C-Suite (CEO & CFO) language & talk tracks, Self-funding sales strategies

Discover how to deconstruct the “BUCA black box” to demystify fully insured health plans for employers.

Get the “Crawl, Walk, Run, Fly” strategy to move an employer incrementally from fully insured to a high-performance, self-funded plan.

Hone and learn selling skills in six sessions that combine expert sales training with panel discussions featuring some of the industry’s top producers.

Learn OR reinforce your knowledge of key components of the healthcare stack and sales strategies on how to sell high-performing self-funded plans.

SPEAKERS

Cathy AitkEn

Corporate Benefit Analysts

Steven Amiel

NextGen Benefits

Josh Butler

Butler Benefits & Consulting

Josh Butler is the founder and President of Butler Benefits & Consulting, a healthcare consulting and brokerage firm, established in 2015 and located in Amarillo, TX. Prior to the creation of Butler Benefits, Josh worked exclusively with employers large and small, providing consulting/advising services in the areas of ancillary benefits, health insurance, IRS compliance, and ACA regulations for one of the nation’s largest ancillary carriers.

In 2017, Josh was recognized as one of the first 60 Health Rosetta Certified Advisors in the United States. The Health Rosetta Accredited Advisor Program is an exclusive ecosystem of healthcare advisors who have illustrated exceptional transparency, innovation, and execution in the areas of risk management, employee benefits, and high-performance plan design. Butler Benefits is very proud and honored to be part of a movement that is helping employers provide better care for 157 Million Americans while reducing health benefits spending by 20-40%.

Josh’s work as a consultant has been nationally recognized in various publications, including Salon, Benefits Pro, and Pro Publica. He also speaks a numerous industry events and conferences.

2022 proved to be a break-out year for Josh and for Butler Benefits as their flagship health plan, High Plains Health Plan, was launched. HPHP is a visionary community health plan aimed at reducing healthcare costs while improving accessibility. This initiative stands as a testament to Josh’s relentless pursuit of solutions in healthcare. Josh was also recognized in 2022 by Benefits Pro magazine as “Broker of the Year”, marking his dedication and expertise in the healthcare consulting field. This accolade was a nod to his team’s exceptional skill in building meaningful solutions in the healthcare benefits and insurance space.

Industry Experience: 16 years

Level of Education: Bachelor’s Degree from West Texas A&M University (2005)

Family/Interests: Wife, Allison; Son, Brooks (13); Son, Ellis (3). Outdoors, hunting, fishing, coaching Brook’s basketball team, cooking, travel

John Clay

BetterSource Benefits

Ben Conner

Conner Insurance

After graduating with a finance degree from Indiana Wesleyan University in 2006, Ben joined his family business, Conner Insurance, as an insurance advisor. His strengths in strategic planning, finance, and communication quickly established him as a top advisor in the firm and the US. By his late 20s, he was working with some of Indiana's largest companies.

Promoted to CEO in 2013, Ben and his partners acquired Conner Insurance in 2015, and have since doubled its revenue and expanded to over 50 employees. His clients have seen exceptional health plan performance, with many of them experiencing flat or reduced healthcare expenses over the last 5-10 years. Under his leadership, Conner Insurance has been recognized multiple times as one of America's Healthiest Workplaces and Best Places to Work in Indiana.

Ben has received several prestigious industry awards, including Most Innovative Healthcare Consultant in 2023 at the YOU Powered Symposium and was a finalist for the Broker of the Year award in 2020 by BenefitsPro. In 2021, he was honored as a Forty under 40 recipient by the Indianapolis Business Journal.

Ben lives in Indianapolis with his wife, Alyssa, and their three daughters. He enjoys reading, playing and watching sports, traveling, and spending time with his family.

David Contorno

E Powered Benefits

David Contorno Founder & President, E Powered Benets David Contorno is a national trailblazer in the healthcare benets industry, transforming how employers design and manage their health plans. As the Founder and President of E Powered Benets, he has spent over two decades advocating for transparency, cost control, and innovative strategies that make healthcare more accessible and understandable for businesses and their employees. Forbes recognized David as one of "America's Most Innovative Benets Leaders" for his tireless work to reform a system often bogged down by rising costs and lack of transparency. At the helm of E Powered Benefits, David focuses on creating tailored, high-value health plans that put employers back in control of their healthcare spending. He works closely with companies to identify and eliminate waste, leveraging data-driven strategies to reduce costs while improving employee health outcomes. His approach allows organizations to achieve substantial savings and provide better healthcare solutions while prioritizing access to high quality healthcare. David also leads the E Powered Benets Co-Consulting Program, a unique initiative where he shares his knowledge with other industry professionals. Through this platform, he teaches benefits consultants how to replicate his successful model of building health plans that emphasize transparency and cost-effectiveness. By mentoring others in the industry, David is amplifying his impact and fostering a new generation of leaders committed to transforming the healthcare benets landscape. In addition to his consulting work, David created and teaches the Certified Health Value Advisor (CHVA) course, credentialed by industry data giant, The Validation Institute, where he educates professionals on the importance of patient advocacy and smarter healthcare decision-making. His contributions to the industry have earned him accolades from top organizations like the World Healthcare Congress and BenetsPro, where he was named Broker of the Year. A sought-after public speaker, David regularly presents at major industry conferences internationally to audiences in the several thousands. Outside of his professional achievements, David is dedicated to philanthropy, particularly in supporting autism advocacy. In his personal time, he enjoys cooking, traveling, and spending time at home with his family. He resides in Davidson, North Carolina, with his wife, Emma, and their children.

Trevor Daer

Granite Peaks Consulting

Trevor has spent his entire professional career in employee benefits, starting at one of the largest privately-held Third Party Administrators in 2009. After learning the ropes of self-insurance and risk-mitigation, he took over as the Director of Prescription Services in 2014 where he fueled the growth of a fledgling cost-plus mail order solution. During this time, he oversaw more than 100 PBM transitions from historically opaque and high-cost options to net-cost focused transparent pharmacy solutions. This experience and the positive results delivered to his customers (saving millions for plans and patients) led to a passion for helping educate others on the nuances that permeate today’s prescription benefit industry. Trevor turned this passion into a pharmacy consulting business, Granite Peak Analytics, in 2019 and hasn’t looked back. Granite Peak Analytics currently provides pharmacy consulting for over 80,000 patient lives across the United States. His experience in self-insured health plans, community pharmacy, and mail-order operations provides a holistic view of pharmacy benefits, eliminating traditional silos that may reduce prescription costs, but increase medical spending or negatively impact patient care. Trevor is sought after speaker on the complex topic of pharmacy benefits along with a licensed producer and benefits consultant.

Allison De Paoli

Altiqe Consulting

Kim Eckelbarger

Tropical Benefits

Kim is the founder of Tropical Benefits, an ARCW Leavitt company. She was nominated nationally as a Broker of the Year, 2022, 2022 Broker of the Year finalist: Kim Eckelbarger | BenefitsPRO. Kim has been profiled in Employee Benefit Adviser (EBA) magazine and was the cover story in their August 2018 edition, highlighting wellness strategies. Kim was named “NextGen Benefits Adviser of the Year” at the 2019 ASCEND conference. Kim has been invited to share learned expertise at prestigious industry conferences, including the Workplace Benefits conference , the BenefitsPRO Broker Expo and the World Health Care Congress 2019. Kim is a co-author of the Amazon bestselling book, Breaking Through the Status Quo, which outlines some of the cutting-edge strategies she and other NextGen Benefits Advisers are using to control and lower healthcare costs.

She is an early adapter of innovative strategies, including Healthcare Abroad, Direct Primary Care, Second Opinions, and Value Based Pricing for hospital claims. She believes that healthcare in the US isn’t financially sustainable and works with employers to build plans for their organizations that are sustainable. She is a hurricane survivor and in her free time, you will find her giving Manatee tours to her friends and family members on Crystal River.

Paul Flowers

Superior Insurance Advisors

His journey in the insurance industry has been marked by innovation, leadership, and a steadfast commitment to excellence, recently recognized by Insurance Business Magazine in their Hot 100 list for 2024.

With a rich background in health insurance and recently completing the work in earning the designation of a Health Rosetta advisor, his career has been dedicated to transforming and elevating organizations through strategic sales initiatives, impactful training, and dynamic leadership. His expertise has been honed across various roles, including Regional Director at Fountain Health and Vice President at USI Insurance Services.

A champion for effective communication and team development, he’s empowered professionals nationwide through speaking engagements and training programs, focusing on practical, sustainable outcomes. His approach blends deep industry knowledge with a passion for coaching, driving transformational change in both individuals and organizations.

Outside of work, he enjoys travel, reading, chess, tennis, and spending quality time with family. His diverse interests and experiences fuel his holistic approach to leadership and business growth.

Join us in this exciting journey as we explore innovative strategies to redefine success in the health insurance and employee benefit landscape.

Doug Geinzer

High Performance Providers

Founder/President

Doug is the founder/president of High Performance Navigation, a boutique consulting firm that works independently with health plans, medical captives, benefit advisors, TPAs, providers, purchasers, and others within the health benefit ecosystem. With over 20 years of experience working within the healthcare industry, Doug has insider knowledge and a firm grasp of the “ins and outs” of creating cost-containment solutions that holds the potential of reducing a health plan’s medical spend by up to 60%.

As an experienced and successful entrepreneur who has built and sold several healthcare, technology and human capital related businesses throughout his career, Doug knows how to deliver results. He is a past recipient of many awards including Entrepreneur of the Year, Healthcare Hero, Innovative Business Leader, Top 40 under 40, “most influential” in employment and a ‘who’s who’ in healthcare. He is the past president of the Vegas Chamber of Commerce’s Business Council and has been a board member of SHRM, Entrepreneur’s Organization, UNLV Schools of Medicine & Nursing and the Las Vegas Medical District.

Doug is happily married with a teenage daughter and loves to travel. As an avid water sports fanatic, you will often find Doug stand-up paddling on any body of water he can find or walking the coastline with his beloved wife.

Nelson Griswold

NextGen Benefits

Randy Hansen

Insurance Office of America

Mark Holland

Benefit Help

Best-selling author, Consultant, CEO of BenefitHelp, NextGen Benefits, and Health Rosetta Advisor. Mark is regularly recognized in the national press and trade journals. In addition, he was featured on CNBC and Bravo’s World Business Review, Benefit News, Benefit and Compensation, and others. Mark's entrepreneurial spirit began with his first business at age 17, and his newest venture, BenefitHelp™, is centered around an innovative approach to using the latest technologies and strategies to improve healthcare and employee engagement in the employee benefits industry. BenefitHelp™ has served several national clients and introduced innovative technologies to the benefits marketplace.

Josh Hyman

Southern Benefit Systems

Josh Hyman, Southern Benefit Systems' CEO and Health Rosetta Certified advisor, uses his healthcare insurance expertise and experience working for a non-profit and as a teacher/coach to improve clients’ financial health and employee care. He is fueled by a personal dedication to finding better solutions for health and wealth.

DAN LaBROAD

Ovation Life & Health

Ed Ligonde

Nava Benefits

Edwige Ligondé is a Partner and Market Director at Nava Benefits, where he is dedicated to redefining employee benefits as the true "benefit of being an employee." With a strong belief that benefit education is key to creating workplaces where employees thrive, Ed strives to help employers become more enjoyable places to work while empowering employees to navigate a complex benefits landscape with confidence.

Ed’s journey began at UCLA, where he was part of the #1 recruiting class for the Men's Soccer program. His time on the field, culminating in a national championship appearance during his junior year, instilled in him the values of teamwork, time management, and camaraderie—skills that have been instrumental in his successful career as an employee benefits consultant.

Throughout his career, Ed has had the privilege of working with incredible clients and colleagues, earning numerous accolades along the way. These include recognition as one of the Los Angeles Business Journal's Top 40 under 40, Top Adviser Awards, MVP, Rising Star, and the prestigious title of 2021 BenefitsPro Broker of the Year.

Outside of work, Ed enjoys spending time with his family, coaching soccer, traveling, wine tasting and indulging in his passion for Formula 1. A devoted fan of international soccer, he proudly supports Arsenal.

DANIEL McCAULEY

Mac Consulting Group

Rachel McLauchlin

Evergreen Benefits Group

Steve Napolitan

More Business More Life

Chris Olsen

Olsen Benefits Group

Stefanie Pigeon

Affiliated Associates

Troy Reichert

TR Strategies

Chelsea Ryckis

Ethos Benefits

Chelsea Ryckis is the founder and president of Ethos Benefits, a firm dedicated to advancing fiduciary-driven health insurance strategies for employers nationwide.

Originally from Canada, Chelsea had her first interaction with the American healthcare system when she sustained a traumatic brain injury during her college sports career that stopped her from attending medical school. Using the lessons learned during that time, Chelsea discovered her ethos; if something can be done better, it should be. As a trailblazer in her industry, Chelsea speaks on national stages and educates HR, CFO and advisors in her industry on how to bring the highest quality care at the most affordable price using data. She has been a featured presenter at ALM Benefits Pro Expo, SHRM, Validation Institute, HR Florida, and ISCEBS. Chelsea produced a documentary It’s Not Personal, It’s Just Healthcare, which interviews CEOs, human resource professionals, hospital executives, insurance industry experts, doctors and nurses, who blow the whistle on insurance companies’ propaganda and corruption. Chelsea also co-hosts the Ethos Effect podcast with her husband, Donovan, where they interview entrepreneurs who are using their own ethos to transform their industries. She was awarded the YPS Most Innovative Healthcare Consultant in the United States for 2024, and received the industry’s most prestigious award, Advisor of the Year by Benefits Pro. Chelsea proudly became an American citizen in 2024. As part of Chelsea’s personal ethos, she enjoys the beach, paddleboarding, and being active with Donovan and her service dog, Copious

Bill Schmaltz

Einstein Consulting Group

Bill is founder of The Einstein Consulting Group – a firm dedicated to exposing and eliminating overspend often found in employer-based healthcare plans. The result is: better quality employee benefits at a lower cost.

Bill advises employer organizations on how to identify the many inefficiencies that have caused them and their employees to overpay for their health care plan and at the same time provides the solutions that address the profit drain.

With pharmacy costs being the fastest rising cost within healthcare, Bill has become an expert in pharmacy cost management. He works with his clients to custom design an approach to their pharmacy program that significantly reduces both the employer’s benefits costs and employees’ costs too.

As a member of the NEXTGEN Mastermind Partnership, Bill is revolutionizing employee benefits. Through his knowledge and expertise, executives are empowered to improve the quality-of-care employees receive and turn healthcare into a controllable cost.

As a healthcare and prescription cost crusader as well as speaker and author, Bill is a passionate advocate for reshaping American healthcare for the better. Through his Amazon #1 bestselling book “Fixing American Health care” and as a featured producer and consultant of the eye-opening documentary film, “It’s Not Personal, It’s Just Healthcare”, Bill aims to bring clarity and solutions to the healthcare industry.

Terry Shook

Primum Risk Strategies

Terry Shook has 44 years of experience in the employee benefits field, with over half of that time spent in leadership positions with health insurance carriers. He has worked with a wide range of brokers and employers from small businesses to major national companies

The last 20 years of his career was spent with Health Care Service Corporation, the parent company of Blue Cross Blue Shield of Illinois, Texas, New Mexico, Oklahoma, and Montana. Most of his time was spent as Regional Director, North Region with Blue Cross Blue Shield of Illinois, where he was responsible for group sales and account management. After he left the carrier world Terry developed a consciousness of crisis based on the hidden profiteering tactics he participated in and often created. He developed clarity of how the status quo health insurance system uses the lack of transparency to exploit their own employer clients and take advantage of employees and families when they’re most vulnerable. Terry now works with employers in Northern Illinois and Southern Wisconsin to help them avoid the pitfalls of the traditional carrier system and take back control of their health spend and ensure quality and safety of the health care they pay for.

Terry earned the Registered Health Underwriter designation from the American College, Bryn Mawr, PA. in 2000 and completed the Certified Employee Benefit Specialist program from the Wharton School of Business, University of Pennsylvania in 2001. He is also a Certified Health Value Advisor conferred by The Validation Institute.

Shabsai Shuchatowitz

Evergreen Benefits Group

Dan Thompson

Thompson Risk

Patrick Thornton

AndersonThornton Consultants

Larry Turell

Customized Consulting Services

Rob Winfrey

ICI Benefits

Rob L. Winfrey is a leading Employee Benefits Consultant at Insurance Center, Inc. brining 26 years of experience to the field. He specializes in Self-Funding, Level-Funding, Direct Contracts, and other Employer provided benefits. He brings a proven track record of helping organizations achieve their benefits objectives. He holds a Bachelor of Science in Business Management and Accounting from Baker University. From his 26 years of industry experience, he is a recognized expert in the Employee Benefits industry.

Prior to joining ICI as the Vice President of Employee Benefits he has been a Senior VP of Sales & Client Engagement for IPC, Oasis, &Fortune Business Solutions, Aflac – Presidents Club District Manager, and Scratch Agency Owner at Encompass HR Solutions, Inc... From his experience Rob is very passionate about helping businesses maximize their benefits at the same time lowering their annual cost of their employee benefits. Rob also brings 10+ years of Coaching competitive Girls Club Basketball on the Nike, Adidas, and AAU circuits.

Chris Wolpert

Group Benefit Solutions

Chris Wolpert is the founder of Group Benefit Solutions, who's mission is to eliminate employee's out-of-pocket costs while guiding them to the highest quality healthcare available.

Chris is a producer of the documentary, "It's Not Personal, It's Just Healthcare" about the misaligned incentives in the healthcare and health insurance industries, which was released in April 2024. He is also an Amazon best-selling author of NextGeneration Healthcare as well as the comic book Hit Zero: The Quest to Make Healthcare a Controllable Expense.

Chris has received several industry awards including "Rising Star" by Employee Benefit News, and "Face-of-Change" by Benefits PRO. He's been a guest speaker at national conventions as well as local events, and has been interviewed for stories appearing in US News & World Report, SELF Magazine, Cluch.co, Moneyish.com, Employee Benefits News, and Benefits PRO.

Chris is originally from Tacoma WA and received his BA from the Edward R. Murrow School of Communication at Washington State University in Pullman (Go Cougs!). Chris’ wife, Valerie is the owner of Natural Venom All-Stars, a competitive cheerleading gym in Tacoma that has won 2 international championships (2012, 2018). They reside in Steilacoom with their 3 beautiful children, Cara, Carly, and Luke.

STILL NOT CONVINCED?

Program Tracks

Breakout sessions will include a 15-minute educational presentation followed by a moderated panel discussion featuring some of the industry's most successful producers sharing their in-the-trenches experiences and sales techniques, tips & hacks.

FOUNDATIONAL PROGRAMMING TRACK

For producers new to self-funding and consultative selling.

- Become confident and comfortable with consultative selling & self-funding

- Elevate to the C-Suite

- Sell self-funded plans successfully, and

- Identify self-funding opportunities.

ADVANCED ADVISER PROGRAMMING TRACK

For consultative advisers working in the C-Suite and experienced with self-funding.

- Sharpen your selling skillset

- Strengthen your knowledge of the NextGen health plan stack.

- Discover advanced strategies to differentiate and drive value in the C-Suite.

Conference Agenda

Still thinking about it? Check out the Conference Agenda!

11:00 AM EST

KEYNOTE

Employee Benefits is a Sales Game – Proven Strategies to WIN The Game

Speaker: Nelson Griswold

Employee benefits is a zero-sum game – there are always winners…and losers. Discover in this session – and during this conference – how to become one of the big winners in our industry…more revenue, more respect, more time for your family, more fun for you!

All successful employee benefits agencies know they are a sales organization, and all successful benefits producers know they are a sales professional. Benefits is a sales game, but a game that has become harder and harder to win, especially for small to mid-size independent agencies and producers.

In this high-energy keynote presentation, controversial industry icon Nelson Griswold, founder of the legendary NextGen Benefits Mastermind Partnership, will share the specific strategies that have made his Mastermind members and his private clients some of the industry’s most successful advisers.

Nelson will reveal the insider secrets that have propelled some of his agency clients to 82%, 53%, 124%, and 65% annual organic growth. His clients as a group annually grow their book an average 28%! (industry average is less than 9%) Discover how these agencies and producers are defying the odds to win bigger, mid- market groups from bigger – even national – brokers.

In this session, you will discover:

- The NUMBER ONE mistake that will kill your sales growth (super easy to fix)

- The surefire strategy to hit your 2025 sales goals (easy…like painting by numbers)

- The three NextGen differentiation strategies that let you disrupt your market (and turn you into a “giant killer”)

- The number one strategy to control the sale & boost your hit rate 50% (only the top 3% of advisers do this)

12:00 PM EST

Deconstructing the BUCA Black Box – Demystifying the Fully Insured Health Plan

Moderator: Allison De Paoli

To employers – and most brokers – BUCA (Blue Cross, UnitedHealth, Cigna, Aetna) fully insured plans are a mystery, seen as a complex and complicated mechanism hidden in an impenetrable black box.

A top NextGen Benefits adviser will deconstruct the BUCA Black Box, demystifying employers’ second largest operating expense. They will share how demystifying the black box empowers your clients to make educated and rational decisions about their healthcare spend. And makes you look really smart.

The moderator then will direct a discussion with prominent advisers on how they use this powerful strategy to win business and turn employers into active partners in improving their health plan.

- The six basic elements of a fully insured (actually any) health plan (how “complex” is that?)

- How to give the employer power over their health plan and healthcare spend. (business owners, CEOs & CFOs crave power)

- The differences between a BUCA fully insured plan and a NextGen health plan (the differences can mean $2,000+ per employee savings to the employer)

12:00 PM EST

Crawl, Walk, Run, Fly – Meet Your Prospects Where They Are & Sell a Gradual Migration from Fully Insured to a NextGen Self-Funded Plan

Moderator: Aaron Witwer

Change is an investment and not every employer is ready to make the investment to change their health plan now. Moving a client to a NextGen-style high-performance plan usually involves an incremental strategy that eases them into the NextGen model gradually.

Industry authority Aaron Witwer will guide you through the incremental steps you can take with your client to move them from fully insured to a NextGen self-funded plan with effective cost containment. He will provide you with some of the psychology behind an effective consultative conversation with a C-Suite decision maker on an incremental strategy.

A panel of seasoned advisers join Aaron to share how they gauge a CEO’s or CFO’s tolerance for change and their own strategies for taking clients through incremental change.

In this session, you will discover:

- A brilliant C-Suite Talk Track that disarms your prospect, lays the groundwork for an incremental strategy, and wins you the BOR (one of Nelson’s closely guarded creations reserved exclusively for Mastermind members…UNTIL NOW!)

- The powerful insight from one of Nelson’s Mastermind advisers that has generated over $12 million in new business (and makes your job so much easier!)

- Proven strategy you use with their BUCA fully insured plan to save the employer money AND get claims data (huh... change with no change?! Yep and easy to sell & implement!)

- A brilliant C-Suite Talk Track that disarms your prospect, lays the groundwork for an incremental strategy, and wins you the BOR (one of Nelson’s closely guarded creations reserved exclusively for Mastermind members…UNTIL NOW!)

- The powerful insight from one of Nelson’s Mastermind advisers that has generated over $12 million in new business (and makes your job so much easier!)

- Proven strategy you use with their BUCA fully insured plan to save the employer money AND get claims data (huh... change with no change?! Yep and easy to sell & implement!)

1:00 PM EST

SALES SUCCESS WORKSHOP

Create Your Personalized Sales Plan – Hit Your 2025 Goals… Guaranteed!

Speaker: Nelson Griswold

What gets planned, gets accomplished. In this hands-on workshop, Nelson Griswold, the industry’s premier sales coach, will give you his proven, proprietary Sales Plan Worksheet and will walk you through a step-by-step process to build your own personalized 2025 sales plan that will lay out your entire year’s sales activity.

Craft your sales plan accurately, follow it religiously, and you are guaranteed to hit your 2025 sales goals.

You will walk away from this workshop with your own personalized 2025 Sales Plan to follow for sales success. (a no-brainer for smart & ambitious agency leaders and producers)

1:00 PM EST

Low Hanging Fruit – Quiet Cost Cutting with Rx

Moderator: Trevor Daer

25-30 percent of healthcare costs are the result of fraud, waste, and abuse. This high percentage of unnecessary cost makes for an inviting target for cost-containment.

But everything in life involves a tradeoff and healthcare cost-containment is essentially a tradeoff between cost savings and employee noise. That is, the greater the cost savings, usually the greater the noise from employees who feel somehow inconvenienced by the changes required to lower costs.

A notable exception to this usual tradeoff is pharmacy, where reducing the rampant waste, fraud, and abuse is basically noise free. Pharmacy expert Trevor Daer, President of Granite Peak Consulting and the Director of Pharmacy for NextGen Benefits, will explain the basics of health plan drug programs. He will reveal the pharmacy cost-containment strategies that have a tremendous impact on health plan costs without generating much, if any, noise.

Trevor then will facilitate a panel discussion featuring noted healthcare advisers on their preferred strategies to control and lower pharmacy costs and the lessons they’ve learned about managing drug costs.

In this session, you will discover:

- The three cost-containment options for high-cost specialty and maintenance drugs (can reduce costs by 60-100!)

- Some of the PBM practices that led Ohio's Attorney General to call them “modern day gangsters” (use these to close new business!)

- How to use pharmacy costs to get meetings with the C-Suite (simple to do & can help close the case, too!)

2:00 PM EST

Presentation

SELL WITHOUT SELLING – Gain Clients Without Convincing or Chasing

Speaker: Steve Napolitan

Learn how to earn more money by gaining clients in less time, and with more ease and more heart…from Nelson’s all-time-favorite personal business coach! Speaker and author Steve Napolitan, founder of the executive coaching program, More Business, More Life, is a highly regarded sales authority.

“Selling” typically means someone is pitching. Stop pitching!!! We must move beyond these old techniques and tools. Selling is not about transactions. It is about connecting with another human being on a deeper level, finding a win-win situation in which all parties will be able to fulfill both their personal and business goals. In this interactive talk, Steve teaches how to easily share your gifts, knowledge, products and services with your Wow Clients and get

paid well for it without hard selling.

This is an opportunity for you to learn how to communicate more effectively with other human beings so when you find a match they say "YES."

No matter what area of business you are in, the skills you will learn in this talk will enhance your ability to influence results across all facets of your business: Sales & Negotiation, Leadership, and/or Joint Business Ventures.

- How to earn more money while making a positive difference in your client’s lives (the ultimate ‘Doing well by doing good’)

- Skills that enhance your verbal & nonverbal communication (learn Steve’s Ninja communication techniques!)

- How to increase your emotional intelligence (acquire clients with all your heart, not sales tricks)

3:00 PM EST

Consultative Selling – From Broker to Advisor in Three Steps

Moderator: Nelson Griswold

If you are tired of being viewed as a commodity and want to differentiate yourself to win more business, the key is consultative selling. Consultative selling is not a talent, but a skill that every broker can learn and master.

In this insightful session, Nelson Griswold, the industry’s most successful sales coach, will share the details of his top strategy that has transformed his Mastermind members and top clients from transactional brokers into consultative advisers who successfully compete with bigger, even national, brokers.

Nelson will be joined by a panel of highly successful consultative advisers who will reveal their best consultative techniques and discuss what works and what to avoid in consultative selling.

In this session, you will discover:

- The FATAL MISTAKE salespeople make in the prospect conversation (avoid this or your sale is dead in the water)

- The one skill that separates consultative advisers from commoditized brokers (hint: it’s something you already do every day)

- The consultative superpower that creates instant rapport with your prospect (Nelson personally swears by this one…it’s like magic!)

3:00 PM EST

SALES SUCCESS WORKSHOP

Controlling the Sales Conversation with Questions – A Consultative Approach to Getting to “Yes”

Speaker: Daniel McCauley

The first meeting with a prospect, and the first 10 minutes of that meeting, usually determine the success or failure with that opportunity. Meetings with a CEO or CFO prospect are hard to come by, the stakes are extremely high, and your margin for error is slim.

NextGen Adviser Daniel McCauley will share the sales conversation he used to build a

$550,000 book of business from scratch in just 20 months! This sales conversation is based on proven psychology and drawn from Daniel’s real-world experience in 7 years as a top producer in software sales.

Aside from asking questions, imagine not speaking for the first 20 minutes of the initial prospect meeting. Daniel will show you how doing exactly that puts you in the driver’s seat in the sales conversation and sets you up to control the conversation.

In this session, you will discover:

- The structured format of Daniel’s sales conversation (only 4 steps…but crazy effective!)

- The specific questions to ask to grab the prospect’s interest and engage her emotions (you’ll be amazed at how simple the questions are)

- The devious way to follow up the prospect’s answers (so easy and works like a charm)

- The single essential question that reveals your opportunity with the prospect (just one powerful word)

4:00 PM EST

Where the Magic Happens – The Critical Role of Navigation in High-Performance Health Plans

Moderator: Doug Geinzer

A high-performance health plan can contain the most effective cost-containment and care- quality point solutions, but employee utilization and the impact on costs will be negligible without effective navigation. Guiding the right employee at the right time to the right point solution is the secret to higher quality care and lower plan costs.

This session features Doug Geinzer, CEO of High-Performance Providers and the industry’s acknowledged expert on employee navigation, who will dissect the different types of navigation programs to uncover the key elements that make them so effective in guiding employees to the right care and the right providers.

You’ll also meet a panel of top advisers who leverage navigation to make their health plans highly effective for the employees as well as the employer plan sponsor.

- The HUGE MISTAKE advisers make that renders your point solutions useless (so easy to avoid…and so costly if you don’t)

- The critical role of employee incentives in effective steerage (also improves employee retention, recruitment & productivity!)

- Why it’s so important to read the fine print in a navigation vendor's contract (don’t & it can cost you plenty!)

4:00 PM EST

Intentional Selling – How to Build a Prospect Playbook to Close 50% More Opportunities

Moderator: Steven Amiel

Discover the sales secret of the top 3% of the most highly successful advisers. (crazy effective… but most brokers will never do this!)

The most successful producers walk into a first meeting with a thorough understanding of the prospect and the company. They are prepared for an on-point and insightful discussion that will engage the executive and demonstrate their knowledge of the prospect’s business and professional situation.

Steven Amiel, a veteran sales professional and head of marketing for NextGen Benefits, will share how he used a Prospect Playbook strategy to make a fortune selling in the printing industry with an in-depth knowledge of his prospect. He will show you exactly what goes into your Playbook that equips you to engage the prospect, display your knowledge of their company, present the solution that perfectly solves their problem, and close more business.

Steven will lead a discussion with a panel of elite advisers on the power of preparation for a first meeting and how understanding your prospect’s business objectives, situation, and needs can make a huge difference in your close rate.

In this session, you will discover:

- Essential questions you should answer in your Prospect Playbook (Steven will tip the top questions from his own Playbook!)

- Exclusive Research Checklist with where to find the information for your Playbook (Nelson created this to eliminate the guesswork & make it so much easier!)

- How your preparation and Playbook moves you from the back seat to the driver’s seat to drive the sale and close the deal (practical steps that make the process easy)

5:00 PM EST

Controlling Medical Costs – RBP & Direct Contracts

Moderator: Troy Reichert

Reference-Based Pricing (RBP) is one of the most common and effective tools for controlling medical costs. While most brokers think they understand RBP, today’s RBP is no longer the blunt instrument it was originally. In response to the market, RBP has evolved into a sophisticated model that is more collaborative with healthcare providers, reducing noise while still controlling costs.

Direct contracting – for diagnostic testing, primary care, surgeries, hospitals, etc. – is another effective means of controlling medical costs. While the idea of direct contracting intimidates many advisers, access to direct contracts is easier than ever.

Industry expert Troy Reichert, a former TPA president and direct contracting executive, will discuss the latest developments in RBP and how direct contracting has become so much easier to implement in health plans.

A panel of leading advisers will join Troy to share their experience selling RBP and direct contracting, including their success tips and their struggles.

In this session, you will discover:

- How to leverage RBP and direct contracting with your prospect to close the sale (if you’ve got the cajónes to do this)

- The FATAL MISTAKE you cannot afford to make when first implementing RBP in a health plan (can cost you the account… but so easy to avoid)

- How you can ensure success with direct contracts (done well, this makes the employer AND employees happy!)

5:00 PM EST

Selling Self-Funding – Giving Employers Control of Their Healthcare Spend

Moderator: Nelson Griswold

Brokers who are successful with self-funding know how to sell self-funding to the owner or executive in the C-Suite. Understanding how self-funding works isn’t sufficient; you have to be able to educate the prospect and debunk the common myths about self-funding that keep employers from self-funding their health plan.

Nelson Griswold will provide a high-level look at how self-funded health plans work. Then, he will reveal the misinformation that insurance carriers and brokers spread to keep employers stuck in costly fully insured plans. He will give you the language to use to counter the false beliefs that employers have about self-funding.

He will be joined by some outstanding advisers who will discuss how they present self-funding to the C-Suite and share what works best for them to convince employers to move from fully insured to a self-funded arrangement.

In this session, you will discover:

- The three main myths that scare employers away from self-funding (so easy to debunk!)

- The one key fact about self-funding that dissolves the employer’s fear (so easy to explain)

- A powerful illustration of how most employers are overpaying for their healthcare (so the insurance company makes even more profit)

6:00 PM EST

Selling the C-Suite – Elevate Your Sales Conversation

Moderator: Nelson Griswold

Brokers are stuck the HR department, where brokers are viewed as commodities and where you can’t turn around without bumping into another broker trying for the business. And HR is almost always wed to the status quo and can say “No” to innovation in five different languages.

But consultative advisers know that strategic and financial decisions about the health plan and healthcare spend – such as moving to a self-funding arrangement or implementing innovative cost-containment solutions – are made in the C-Suite, by the business owner, CEO, or CFO. And advisers don’t run into any brokers in the C-Suite.

Nelson Griswold, the visionary who first pointed benefits advisers to the C-Suite, will unpack the skillset you need to elevate yourself and your benefits conversation from HR up to the C-Suite. He’ll discuss what you must do – and what you must never do – to close business with the executives in the C-Suite.

A panel of sophisticated consultative advisers will join Nelson to discuss what has made them a success selling the C-Suite and reveal their biggest lessons… and biggest mistakes.

In this session, you will discover:

- The FATAL ERROR that gets you sent from the C-Suite straight to HR so fast your head will spin (easy to avoid & you strengthen your position with the owner, CEO or CFO)

- Why a consultative approach is required for success with C-Suite executives (hint: the problem they need to solve usually not what you think it is)

- Your new role that opens the door to the C-Suite (and opens the door to a lot of additional revenue!)

6:00 PM EST

The Ultimate C-Suite Conversation – Stop Loss Savings & Tax Benefits of a Single-Parent Captive

Moderator: Patrick Thornton

NextGen Benefits is so compelling to the C-Suite because it is a strategic and financial conversation, one that speaks directly to the main concerns of the owner, CEO or CFO. But a single-parent captive, a unique type of self-funding arrangement, provides the ultimate C-Suite conversation, the most strategic and financial conversation you can have with an owner or executive.

Highly successful benefits adviser and former CFO Patrick Thornton will share the basics of the single parent captive and why it is unique among all self-funding arrangements. He will explain why a single-parent captive is so intriguing to the C-Suite. Most important, he will give you the specific language about a single-parent captive you can use to secure a meeting with almost any business owner or executive.

A panel of top advisers will share their experience using the single-parent captive conversation to engage an owner or executive and the success they have had with this powerful strategy.

In this session, you will discover:

- The short & sweet C-Suite Talk Track that gets you a meeting on the single-parent captive (Nelson crafted this so no CEO or CFO can resist!)

- How a single-parent captive slashes the cost of stop loss by 60% to as much as 72%, without any decrements (this is the only known cost-containment for stop loss!)

- The presentation hack that lets you totally avoid having to explain the single-parent captive to the prospect (and dramatically increase your odds of closing the sale!)

STILL UNDECIDED?

Begin the conference now by downloading Debunking The 5 Common Myths Surrounding Self-Funded Healthcare Programs, with our compliments. Written by Nelson Griswold, CEO of NextGen Benefits, this is a perfect example of a client-facing marketing piece that is designed to open doors…

…getting the attention of the CEO or CFO and generating interest in meeting with you.